What is Forex Trading and How Does it Work?

Contents

A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. A spot exchange rate is the rate for a foreign exchange transaction for immediate delivery.

The prospect of reduced note circulation, bank loans, and the depressing impact on prices, employment and production had been removed. As such, countries were now free to pursue their own policies with no immediate regard for what other countries were doing. The coordinating discipline imposed by the gold standard had gone. In this example, the fall in demand in the UK would reduce imports, and exports would become more competitive as prices fell. Employment would be restored, the current account would be returned to equilibrium and another cycle would begin. A deficit on the current account could not be corrected by a devaluation of the currency because under the gold standard mechanism the currency was fixed in value.

You are still betting on the price movement of a currency pair, and you are still not taking delivery of the underlying currencies involved. However, if you are looking for more opportunities, a CFD broker like PrimeXBT is the way to go. Best introductory book on foreign exchange market – naturally loved it.

The USD/CNY pair, which sets the American Dollar against the Chinese Renminbi, accounted for 4.1% of daily trades last year. This marks a very slight increase from 2016’s share of 3.8%.45BIS, “Triennial Central Bank Survey”, accessed June 29, 2020. Trading in Chinese Renminbi has seen an increase that was in line with aggregate market growth.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

I will also look at the growth in technical analysis trading models, which has been assisted by vastly enhanced computer power in recent years. The second most popular currency in the forex market is the Euro – accounting for 32.3% of trades.30BIS, “Triennial Central Bank Survey”, accessed June 29, 2020. The largest US-based broker is Forex.com, which is owned by GAIN Capital Holdings inc. It has an average daily trading volume of $15.5 billion.26Wealth&Value, “Largest Forex Brokers in The World 2020”, accessed June 29, 2020. The second-largest global broker is the XM Group, with an average daily trading volume of $13.4 billion.24Wealth&Value, “Largest Forex Brokers in The World 2020”, accessed June 29, 2020. 72% of forex traders have no prior experience in trading in other markets.18Forex School Online, “Forex Statistics & Trader Results From Around the World”, accessed June 28, 2020.

Between 1954 and 1959, Japanese law was changed to allow foreign exchange dealings in many more Western currencies. Central banks use these strategies to calm inflation. Their doing so also serves as a long-term indicator for forex traders. There are many types of banks in a forex market; they can be huge or small. The most sizeable banks deal in huge amounts of funds that are being traded at any instant. It is a common standard for banks to trade in 5 to 10 million Dollar parcels.

Here are some basics about the currency market so you can take the next step and start forex trading. Forex trading without a broker is theoretically possible but so expensive and inefficient as to be a complete waste of time. Such options include banks, exchange offices, and peer-to-peer exchanges. Yet to trade Forex profitably, a broker must be used. Also, the forex market does not only involve a simple conversion of one currency into another.

These numbers are also expected to increase overseas due to heightened globalization efforts seen throughout Europe especially since Brexit along with other forex markets such as India, China, and forex week Russia. “Spread” usually refers to the difference between the bid price and the ask price. Brokers will pocket some of that difference as a way of profiting from the trades that they help execute.

Gross national product Gross domestic product plus income earned from investment or work abroad. Guaranteed order An order type that protects a trader against the market gapping. It guarantees to fill your order at the price asked. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. It is guaranteed even if there’s gapping in the market.

Leverage a comprehensive suite of trading platforms, market insights, data and compliance tools to trade FX spot, FX forwards, and FX options. The currency market is a dealer market made largely by the same dealers active in the bond market. Currency dealers display indicative quotes, but quotes at which trades may occur are usually made bilaterally. Like the bond market, the currency market has an interdealer market in which dealers can trade anonymously with each other.

There are a many ways to trade on the forex market, all of which follow the previously mentioned principle of simultaneously buying and selling currencies. If you believe an FX ‘base currency’ will rise relative to the price of the ‘counter currency’, you may wish to ‘go long’ that currency pair. If you believe the opposite will happen and the market will fall, you may wish to ‘go short’ the currency pair. FX traders take advantage of this by becoming extremely receptive to market news releases and then trade based upon the suspected market sentiment. FX is an industry term that is abbreviated from forex, and is commonly used instead of forex. However, forex is also an abbreviation of foreign exchange.

Size of the Forex Market

As of April 2019, this currency pair’s average daily turnover amounted to $209.6 billion.87BOJ, 2019 Central Bank Survey of Foreign exchange and Derivatives Market Activity”, accessed July 1, 2020. The Japanese Yen is the most traded currency on the Japanese forex market. Is where participants come to buy and sell foreign currencies (e.g., foreign exchange rates, currencies, etc.). Foreign exchange trading occurs around the clock and throughout all global markets.

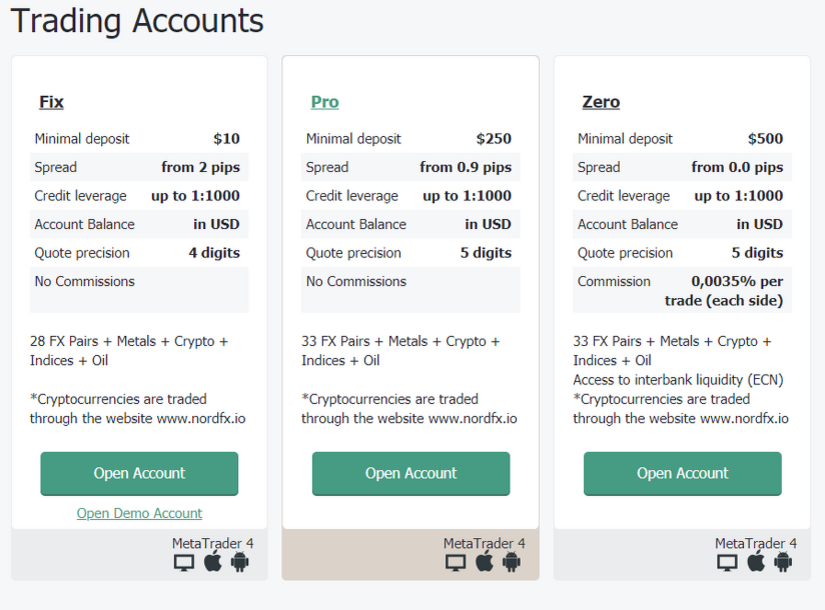

A Forex broker connects traders to the Forex market and enables trading. Traders get trading platforms, assets, quotes, and other trading tools from a Forex broker, which is also responsible for deposits and withdrawals, amarkets mt4 held in separate accounts with custodian banks. Forex brokers either fill orders internally or pass them on. They connect with liquidity providers in an automated process which includes human oversight.

One way to deal with the foreign exchange risk is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. The duration of the trade can be one day, a few days, months or years. Then the forward contract is negotiated and agreed upon by both parties.

The great majority of forex traders have under 3 years of trading experience. 66% of traders make use of daily charts.12Forex School Online, “Forex Statistics & Trader Results From Around the World”, accessed June 28, 2020. Five businesses maintain a 40% share of the global Forex market, according to Euromoney magazine’s 41st annual FX survey released in 2019.7Euromoney, “Euromoney FX Survey 2019”, accessed June 28, 2020. Although it is already immense, the forex market hasn’t slowed down or become sluggish. Some forecasts, such as the one from the IMARC group, predict a compound annual growth rate of 6% in the next five years.4BIS, “BIS Quarterly Review”, accessed June 27,2020.

What is leverage in forex?

The value of equities across the world fell while the US dollar strengthened (see Fig.1). This happened despite the strong focus of the crisis in the US. FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralised global market. It’s one of the largest and most liquid financial markets in the world.

The U.S. currency was involved in 88.3% of transactions, followed by the euro (32.3%), the yen (16.8%), and sterling (12.8%) . Volume percentages for all individual currencies should add up to 200%, as each transaction involves two currencies. Some investment management firms also have more speculative specialist currency overlay operations, which manage clients’ currency exposures with fxcc forex broker the aim of generating profits as well as limiting risk. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Intervention by European banks influenced the Forex market on 27 February 1985. The greatest proportion of all trades worldwide during 1987 were within the United Kingdom .

How Forex Trading Is Largely Expanding Globally

This data provides a look into consumer spending behavior, which is a key determinant of growth in all major economies. Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. Rights issue A form of corporate action where shareholders are given rights to purchase more stock. Normally issued by companies in an attempt to raise capital.

Money transfer

They are regulated by FEDAI and any transaction in foreign Exchange is governed by the Foreign Exchange Management Act, 1999 . National central banks play an important role in the foreign exchange markets. They try to control the money supply, inflation, and/or interest rates and often have official or unofficial target rates for their currencies. They can use their often substantial foreign exchange reserves to stabilize the market.

Individual Investors

G7 Group of 7 Nations – United States, Japan, Germany, United Kingdom, France, Italy and Canada. Gap/gapping A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements. Gearing Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account.

A current account deficit may occur because of government spending, or spending by private firms and individuals. A deficit, whoever is generating it, will need to be financed. This is either through increased borrowing overseas or by a reduction in investments overseas. Borrowings may increase the productive potential of the economy, particularly in a development context. Also, debt may be rising but actually falling as a percentage of Gross National Product . BOJ, 2019 Central Bank Survey of Foreign exchange and Derivatives Market Activity”, accessed July 1, 2020.

Stay up-to-date on the forex market at or find a trustworthy forex broker at (soon to be). A historical archive of real-time pricing data, covering OTC and exchange-traded instruments, from more than 500 trading venues and third-party contributors. Use Deal Tracker to monitor and process every FX trade on all major foreign exchange platforms around the world. ’ winds up with some thoughts on the direction of future micro-based exchange rate research.

The foreign exchange is the conversion of one currency into another currency. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. A rally in stocks Wednesday reduced the liquidity demand for the dollar.

Trading in the United States accounted for 16.5%, Singapore and Hong Kong account for 7.6% and Japan accounted for 4.5%. U.S. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system. After the Accord ended in 1971, the Smithsonian Agreement allowed rates to fluctuate by up to ±2%. In 1961–62, the volume of foreign operations by the U.S. From 1970 to 1973, the volume of trading in the market increased three-fold. At some time (according to Gandolfo during February–March 1973) some of the markets were “split”, and a two-tier currency market was subsequently introduced, with dual currency rates.

What is forex trading?

Instead, they typically close out their buy or sell commitments and calculate net gains or losses based on price changes in that currency relative to the dollar over time. One of the best ways to learn about forex is to see how prices move in real time and place some fake trades with an account called a “paper trading account” . Several brokerages offer online or mobile phone app-based paper trading accounts that work exactly the same as live trading accounts, but without your own capital at risk. There are several online simulators for practicing day trading and honing your forex trading strategy and skills.

The worth of the entire global forex trading market is estimated to approximately $2.4 quadrillion – in other words, around $2409 trillion.1BIS, “BIS Quarterly Review”, accessed June 24, 2020. Now, Forex trading is popular in a number of jurisdictions. There are a number of regulated forex brokers in the United States, and several other leading countries as well. The U.S. dollar is the medium of exchange for many cross-border transactions. Also called “petrodollars.” So if Japan wants to buy oil from Saudi Arabia, it can only be bought with the U.S. dollar. If Japan doesn’t have any dollars, it has to sell its yen first and buy U.S. dollars.